Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

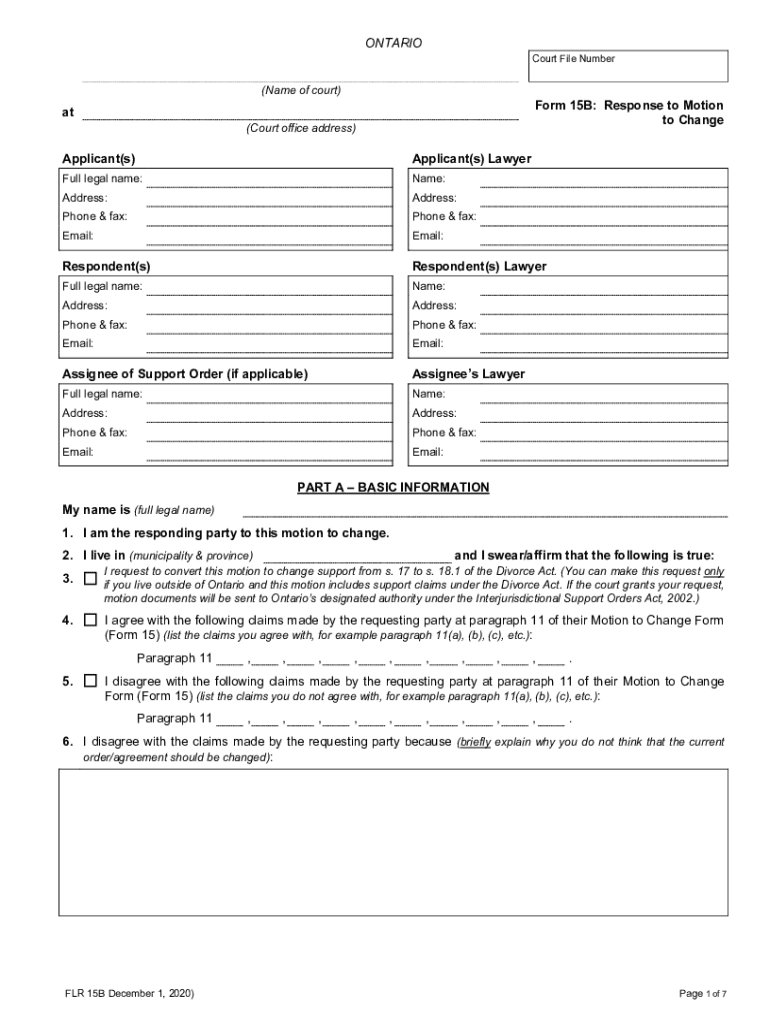

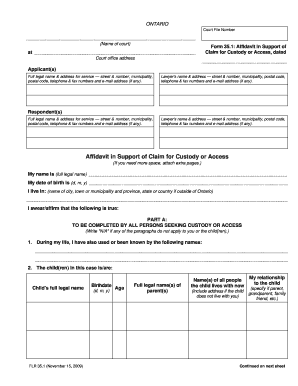

Form 15B is a document used in Canada for the purpose of requesting an order terminating, varying, or setting aside an existing order in a Family Law case. It is specifically used in situations where there is already a court order in place, and one of the parties wishes to modify or terminate that order. The form provides a structured format for the applicant to explain the desired changes and the reasons behind them.

Who is required to file form 15b?

Form 15-B is not a form that needs to be filed by any individual or entity. It is a form issued by the Securities and Exchange Board of India (SEBI) to be used by stockbrokers for submitting their monthly report on the assets and liabilities, client funds, and other relevant information. So, stockbrokers are required to file Form 15-B with SEBI.

How to fill out form 15b?

Form 15B is mainly used for furnishing quarterly return on special transactions of commodities/options or goods and claim for refund of identified tax deducted at source. Here is a step-by-step guide on how to fill out Form 15B:

1. Begin by providing the details of the taxpayer:

- Enter the name of the assessee.

- Fill in the Permanent Account Number (PAN) of the assessee.

- Provide the complete address of the assessee, including the city, state, and PIN code.

2. Enter the details of the Assessing Officer (AO):

- Enter the name of the AO.

- Fill in the designation of the AO.

- Provide the complete address of the AO's office, along with the city, state, and PIN code.

3. Provide the Financial Year for which the return is being filed.

4. Enter the relevant quarter (e.g., Q1, Q2, Q3, or Q4) for which the return is being filed.

5. Fill in the details of the special transactions of commodities/options or goods:

- Mention the date of transaction.

- Provide the unique Identification Number (UIN) issued by the recognized stock exchange for the transaction.

- Enter the name of the commodity or goods.

- Fill in the quantity of goods, in terms of either units or weight.

- Mention the rate at which the transaction took place.

6. Calculate the income, expenses, and tax deducted at source (TDS), and fill in the appropriate columns accordingly.

7. If any refund claim for identified tax deducted at source is being made, provide the details of such claim:

- Fill in the date of the claim.

- Provide the certificate number, if applicable.

- Mention the amount claimed.

8. Calculate the amount of interest, if any, and provide the details in the relevant column.

9. At the end of the form, provide the total amount of income, expenses, TDS, and the Net Amount Payable/Refundable.

10. Sign and date the form and provide the capacity (i.e., whether as an assessee, authorized signatory, or tax consultant).

Make sure to review the form thoroughly for accuracy and completeness before submitting it to the appropriate tax authorities. It may also be helpful to refer to the instructions or guidelines provided along with the form for any specific requirements or further details.

What is the purpose of form 15b?

Form 15B is a tax form used in Canada by individuals to calculate and report their prescribed interest income for tax purposes. Prescribed interest refers to interest earned on certain loans made between individuals who are not dealing at arm's length or between partnerships and their members. The purpose of Form 15B is to determine the taxable amount of prescribed interest income and report it to the Canada Revenue Agency (CRA) for income tax assessment and compliance.

What information must be reported on form 15b?

Form 15b is typically used to report the acquisition, disposition, or change in ownership of securities of a reporting issuer. The information that must be reported on form 15b includes:

1. The name and address of the reporting issuer.

2. The name, address, and relationship to the issuer of the person acquiring or disposing of the securities.

3. The date of the acquisition, disposition, or change in ownership.

4. The number of securities acquired, disposed of, or subject to the ownership change.

5. The nature of the transaction (e.g., acquisition, disposition, gift, inheritance).

6. The purchase price or value of the securities involved in the transaction.

7. Any other relevant information or documents that the reporting issuer may require for complete disclosure.

It's important to note that the specific requirements for reporting on form 15b may vary based on jurisdiction and the applicable regulations.

What is the penalty for the late filing of form 15b?

Form 15B refers to the filing of a tax audit report under section 44AB of the Income Tax Act, 1961 in India. The penalty for late filing of Form 15B is mentioned in Section 271B of the Income Tax Act.

If a taxpayer is required to have a tax audit conducted as per the Income Tax Act and fails to do so, or if the taxpayer fails to furnish the tax audit report within the specified due date, then a penalty of 0.5% of the total sales, turnover, or gross receipts, subject to a maximum penalty of INR 1,50,000 will be levied.

It's important to note that this penalty will be imposed in addition to any other penalties or consequences that may arise from non-compliance with the tax audit requirements. The penalty amount can vary depending on the specific circumstances and provisions of the Income Tax Act, and it is advisable to consult with a tax professional for accurate information based on the individual case.

How can I send form 15b response to motion to change for eSignature?

Once your form 15b is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my response to motion to change in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form15b and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit response to motion to change form 15b on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ontario court 15b form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.